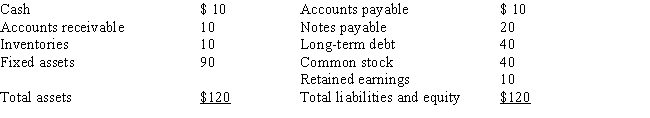

A firm has the following balance sheet:  Fixed assets are being used at 80 percent of capacity; sales for the year just ended were $200; sales will increase $10 per year for the next 4 years; the profit margin is 5 percent; and the dividend payout ratio is 60 percent.Assume that fixed assets cannot be sold.What are the total external financing requirements for the entire 4 years, i.e., the total AFN for the 4-year period?

Fixed assets are being used at 80 percent of capacity; sales for the year just ended were $200; sales will increase $10 per year for the next 4 years; the profit margin is 5 percent; and the dividend payout ratio is 60 percent.Assume that fixed assets cannot be sold.What are the total external financing requirements for the entire 4 years, i.e., the total AFN for the 4-year period?

A) $4.00

B) $2.00

C) −$0.80 (Surplus)

D) −$14.00 (Surplus)

E) $0

Correct Answer:

Verified

Q25: Stromburg Corporation makes surveillance equipment for intelligence

Q26: Q28: Marcus Corporation currently sells 150,000 units a Q30: Carolina Vineyards is considering two alternative production Q30: A firm has the following balance sheet: Q31: Hogan Inc.generated EBIT of $240,000 this past Q31: You have been given the information below Q34: Which of the following statements is correct? Q39: Musgrave Corporation has fixed operating costs of Q41: Elephant Books sells paperback books for $7![]()

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents