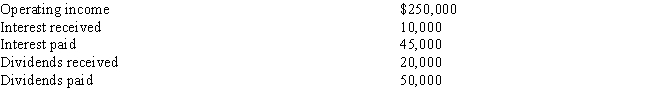

Your corporation has the following cash flows:  If 70 percent of dividends received are excludable, and if the applicable tax table is as follows,

If 70 percent of dividends received are excludable, and if the applicable tax table is as follows,  What is the corporation's tax liability?

What is the corporation's tax liability?

A) $57,530

B) $65,350

C) $69,440

D) $88,350

E) $100,280

Correct Answer:

Verified

Q21: Jane Doe,who has substantial personal wealth and

Q31: Which of the following statements is correct?

A)

Q35: Which of the following statements is correct?

A)

Q37: Allen Corporation can (1)build a new plant

Q39: Which of the following statements is correct?

A)

Q44: Managers of a firm can increase the

Q46: Four of the disadvantages of a partnership

Q49: No firm can take cost-increasing,socially responsible actions

Q51: A hostile takeover involves an attempt by

Q60: The major advantage of a regular partnership

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents