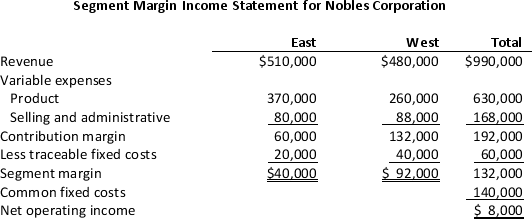

Nobles Corporation provided the following income statement for two of its divisions: East and West.

Nobles' actual weighted-average cost of capital is 10% and its tax rate is 30%.The East division balance sheet showed $300,000 of assets $60,000 current and $240,000 long-term and $320,000 of liabilities $120,000 current and $200,000 long-term.The West division reported $360,000 of assets $80,000 current and $280,000 long-term and $260,000 of liabilities $60,000 current and $200,000 long-term.

Nobles' actual weighted-average cost of capital is 10% and its tax rate is 30%.The East division balance sheet showed $300,000 of assets $60,000 current and $240,000 long-term and $320,000 of liabilities $120,000 current and $200,000 long-term.The West division reported $360,000 of assets $80,000 current and $280,000 long-term and $260,000 of liabilities $60,000 current and $200,000 long-term.

Required:

a.Calculate the economic value added for each division.

b.Which of the two managers will be rated higher on performance? Why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q165: Q166: Q167: Tillamoke Company produces gourmet cheeses.Selected results from Q169: Jackson Brothers Instruments sells stringed instruments.Trent Jackson,the Q171: The Transformer division of Lorman Industries produces Q172: The Assembly Division of Mounds Corporation makes Q173: An organization may be structured as a Q174: Major Corporation operates a wholesale electrical supply Q175: Bill Jones,Flooring's accountant,has prepared the following income Q180: Gooding Custom Design generated $320,000 in operating![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents