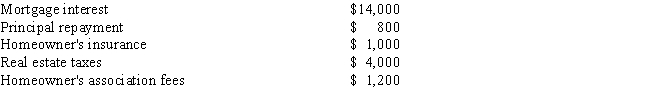

Jackie is in the 28% marginal tax bracket and has no other itemized deductions except those related to her home.If her standard deduction is $6,100 and she incurs the following costs related to housing,how much tax savings will she receive as a result of her home purchase?

A) $13,250

B) $ 5,040

C) $ 3,332

D) $ 2,800

E) none

Correct Answer:

Verified

Q101: If you purchase a house worth $110,000

Q102: When you receive title to an individual

Q102: Which of the following is not associated

Q104: The highest average cost housing to purchase

Q110: A fee charged by lenders as a

Q111: If you made a down payment of

Q114: _ is a reason for owning your

Q115: Which of the following is true regarding

Q133: A lender will usually require a loan-to-value

Q138: If the maximum loan-to-value ratio that a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents