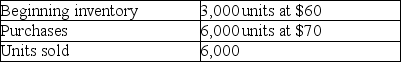

Given the following data,by how much would taxable income change if LIFO is used rather than FIFO?

A) There is no difference.

B) Increase by $30,000

C) Decrease by $30,000

D) Decrease by $40,000

Correct Answer:

Verified

Q42: If a company uses LIFO for tax

Q49: When inventory costs are rising,a company using

Q56: When inventory costs are falling,the LIFO costing

Q58: A LIFO liquidation occurs when _ fall(s)below

Q60: The inventory method used by a company

Q62: The following data was extracted from the

Q63: Given the following data,calculate Cost of Goods

Q64: If inventory costs are increasing over time,the

Q66: Given the following data,calculate the cost of

Q71: If inventory costs are decreasing over time,the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents