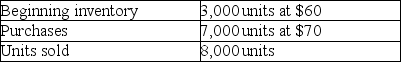

Given the following data,by how much would taxable income change if FIFO is used rather than LIFO?

A) Decrease by $20,000

B) Decrease by $19,000

C) Increase by $20,000

D) Increase by $19,000

Correct Answer:

Verified

Q62: When inventory costs are falling,which inventory costing

Q68: Which inventory costing method provides the most

Q74: The following data was obtained from the

Q75: Given the following data,calculate the Cost of

Q78: Summertime had the following data for the

Q80: A company has a beginning inventory of

Q83: Mariah Company has inventory at the end

Q84: The historical cost of Jahn Company's ending

Q86: When applying the lower-of-cost-or-market rule to inventories,

Q88: The lower-of-cost-or-market rule for inventory is based

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents