On January 1, Year 1, a company had the following transactions:

- Issued 10,000 shares of $2.00 par common stock for $12.00 per share.

- Issued 3,000 shares of $50 par, 6% cumulative preferred stock for $70 per share.

- Purchased 1,000 shares of previously issued common stock for $15.00 per share.

- No other shares of stock were issued or outstanding.

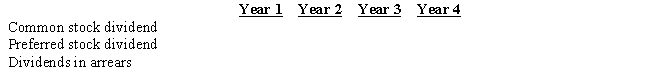

The company had the following dividend information available:

Year 1 - No dividend paid

Year 2 - Paid a $2,000 total dividend

Year 3 - Paid a $20,000 total dividend

Year 4 - Paid a $25,000 total dividend

Using the following format, fill in the correct values for each year:

Correct Answer:

Verified

Q159: Sabas Company has 20,000 shares of

Q161: Using the following accounts and balances,

Q162: A corporation, which had 18,000 shares

Q164: Selected transactions completed by Breezeway Construction during

Q165: A company had the following stockholders' equity

Q167: At December 31, Idaho Company had the

Q168: On March 4 of the current year,

Q173: On April 10, Maranda Corporation issued for

Q198: Carmen Company is a corporation that has

Q216: On June 5, Belen Corporation reacquired 3,300

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents