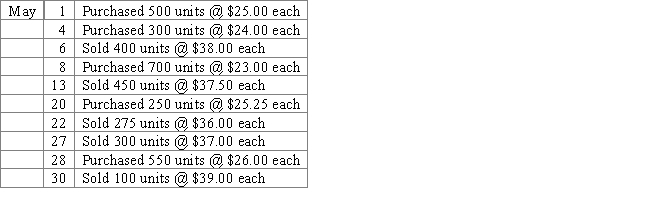

Brutus Corporation, a newly formed corporation, has the following transactions during May, its first month of operations.

-Using the table provided, calculate total sales, cost of goods sold, gross profit, and ending inventory using each of the FIFO perpetual inventory method.

A) Total sales: $56,975.00

Cost of goods sold: $36,431.25

Gross profit: $20,543.75

Ending inventory: $19,981.2

B) Total sales: $56,975.00

Cost of goods sold: $36,587.50

Gross profit: $20,387.50

Ending inventory: $19,825.00

C) Total sales: $56,975.00

Cost of goods sold: $37,312.50

Gross profit: $19,662.50

Ending inventory: $19,573.25

D) Total sales: $56,975.00

Cost of goods sold: $37,401.75

Gross profit: $19,573.25

Ending inventory: $19,010.75

Correct Answer:

Verified

Q186: On the basis of the following

Q187: Assume that three identical units of

Q188: On the basis of the following data

Q189: The following data were taken from

Q190: Basic inventory data for April 30

Q192: During the taking of its physical inventory

Q193: The following data were taken from Castle,

Q194: Assume that three identical units of

Q195: Brutus Corporation, a newly formed corporation, has

Q196: Addison, Inc. uses a perpetual inventory system.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents