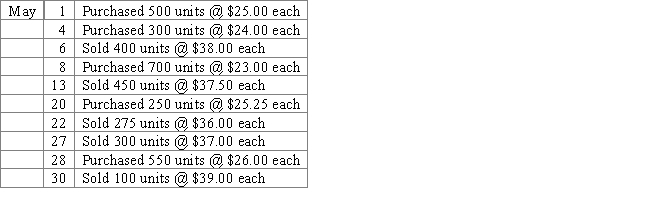

Brutus Corporation, a newly formed corporation, has the following transactions during May, its first month of operations.

-Using the table provided, calculate total sales, cost of goods sold, gross profit, and ending inventory using each of the LIFO perpetual inventory method.

A) Total sales: $56,975.00

Cost of goods sold: $36,431.25

Gross profit: $20,543.75

Ending inventory: $19,981.2

B) Total sales: $56,975.00

Cost of goods sold: $36,587.50

Gross profit: $20,387.50

Ending inventory: $19,825.00

C) Total sales: $56,975.00

Cost of goods sold: $37,312.50

Gross profit: $19,662.50

Ending inventory: $19,573.25

D) Total sales: $56,975.00

Cost of goods sold: $37,401.75

Gross profit: $19,573.25

Ending inventory: $19,010.75

Correct Answer:

Verified

Q195: Brutus Corporation, a newly formed corporation, has

Q196: Addison, Inc. uses a perpetual inventory system.

Q197: Brutus Corporation, a newly formed corporation, has

Q198: Applying the lower of cost or

Q199: Addison, Inc. uses a perpetual inventory system.

Q201: The following lots of a Commodity P

Q202: The following lots of a Commodity P

Q203: Complete the following table using the perpetual

Q204: Beginning inventory, purchases, and sales data for

Q205: The following lots of a Commodity P

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents