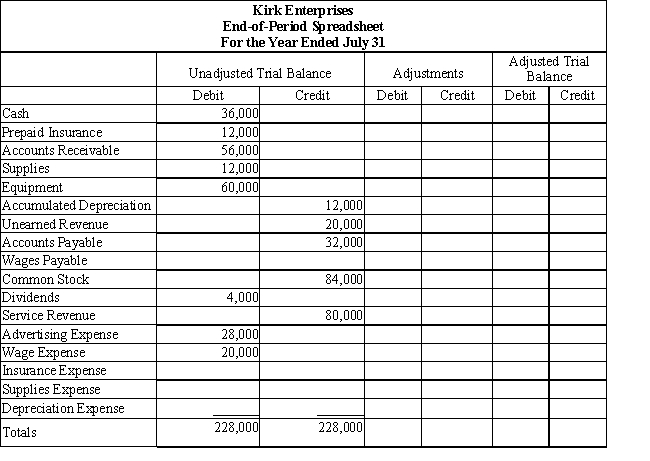

Kirk Enterprises offers rug cleaning services to business clients. Below is the adjustments data for the year ended July 31. Using this information along with the spreadsheet below, record the adjusting entries in proper general journal form.

Adjustments:

(a) Depreciation expense, $1,000.

(b) Wages accrued, but not paid, $2,000.

(c) Supplies on hand, $8,000.

(d) Of the unearned revenue, 75% has been earned.

(e) Unexpired insurance at July 31, $9,000.

Correct Answer:

Verified

Q189: Complete the following end-of-period spreadsheet for Danilo

Q190: On the basis of the following data

Q191: The following adjusted trial balance is the

Q192: After the accounts have been adjusted at

Q193: The balances for the accounts listed below

Q195: Prepare closing entries from the following end-of-period

Q196: The end-of-period spreadsheet for the current year

Q197: Kirk Enterprises offers rug cleaning services to

Q198: The following adjusted trial balance is the

Q199: After all adjustments have been made, but

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents