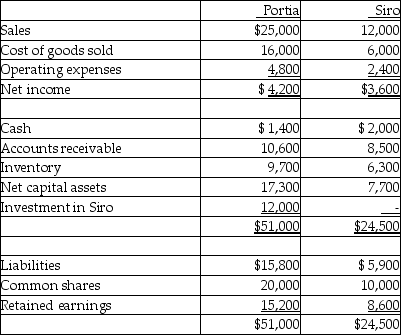

Portia Ltd. acquired 80% of Siro Ltd. on December 31, 20X0. At the acquisition date, Siro's net assets totalled $15,000. Portia uses the cost method to record the acquisition and consolidates using the entity method. At December 31, 20X1, the separate-entity financial statements showed the following:

- During 20X1, Siro sold $7,000 of goods, with a gross margin of 40%, to Portia. At the end of 20X1, $3,000 of the goods were still in Portia's inventory. What is Portia's consolidated cost of goods sold for 20X1?

A) $13,800

B) $16,200

C) $16,800

D) $22,000

Correct Answer:

Verified

Q10: On December 31, 20X2, Bates Ltd.

Q11: Portia Ltd. acquired 80% of Siro Ltd.

Q12: Olthius Ltd. purchased 60% of Fredo Ltd.

Q13: Portia Ltd. acquired 80% of Siro Ltd.

Q14: What is the purpose of showing an

Q16: Taguchi Ltd. owns 80% of Shag

Q17: Bates Ltd. owns 60% of the

Q18: Which consolidation approach includes only the parent's

Q19: Which of the following is not a

Q20: Lopez Ltd. purchases 65% of Wheatfall Co.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents