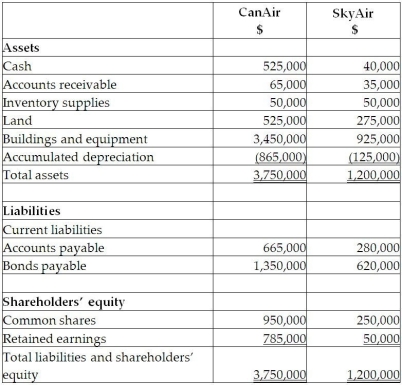

On September 1, 20X5, CanAir Limited decided to buy 100% of the shares outstanding of SkyAir Inc. for $900,000. CanAir will pay for this acquisition by using cash of $500,000 and issuing share capital for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X5, are as follows:  After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

• Land has a fair value of $225,000.

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• Internet domain name has a fair value is $55,000. The domain name is estimated to have a useful life of five years.

• Customer lists have a fair value is $35,000. It is estimated that the customer lists will have a useful life of seven years.

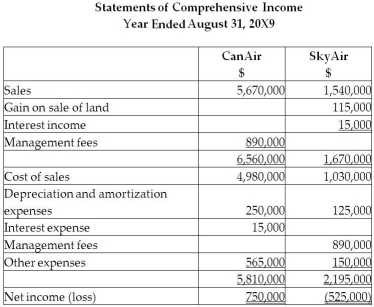

During the 20X9 fiscal year, the following events occurred:

1. On March 1, 20X9, SkyAir sold land to CanAir for $390,000, which had a carrying value of $275,000. CanAir paid for this with $90,000 cash and a note payable for the difference. This note pays interest at 10%, which is paid monthly.

2. CanAir provided management expertise to SkyAir and charged management fees of $890,000.

3. CanAir sold supplies (included in CanAir sales)to SkyAir for $200,000. CanAir charged SkyAir an amount that was 25% above cost. SkyAir still has supplies on hand of $70,000.

4. In 20X8, SkyAir provided seat space on flights to Can Air for a value of $500,000. This amount was included in sales for SkyAir. Profit margin on these sales is 40%. At the end of August, 20X8, CanAir still had an amount of $200,000 in these prepaid seats that had not yet been used. (CanAir includes this in inventory.)

Required:

Required:

Calculate the consolidated retained earnings as at August 31, 20X9.

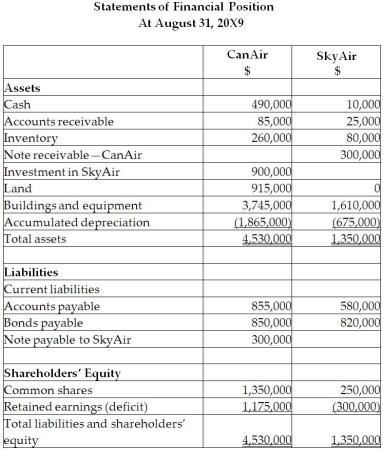

Prepare the consolidated statement of financial position for the year ended August 31, 20X9.

Correct Answer:

Verified

Q16: DC Company purchased 80% of the outstanding

Q17: Paranich Co. acquired Crowley Co. in a

Q18: Fair value increments on depreciable assets _.

A)should

Q19: Mitzi's Muffins Ltd. purchased a commercial baking

Q20: Inventory was acquired as part of a

Q22: Which of the following statements about goodwill

Q23: On December 31, 20X2, Pipe Ltd.

Q24: On December 31, 20X5, Space Co.

Q25: On January 1, 20X3, Dwayne Ltd.

Q26: Which of the following consolidation adjustments will

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents