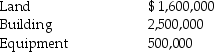

Glenmore Reservoir Corporation paid $4,000,000 in a lump-sum purchase of land, a building, and equipment. The payment consisted of $1,500,000 cash and a note payable for the balance. An appraisal indicated the following fair values at the time of the purchase:

Prepare the journal entry to record this lump-sum purchase (round all percentage calculations to two decimal places).

Prepare the journal entry to record this lump-sum purchase (round all percentage calculations to two decimal places).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The cost of paving a parking lot

Q7: The cost of land would include all

Q9: Land is purchased for $60,000.Back taxes paid

Q13: Treating a capital expenditure as an immediate

Q22: Rocky Mountain Water Corporation paid $270,000 to

Q23: Discuss the type of tangible long-lived assets

Q39: Which of the following depreciation methods best

Q67: Of the tangible long-lived assets, buildings are

Q95: Land improvements are subject to depreciation.

Q96: Immediate expenses are those that maintain the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents