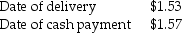

Suppose a Canadian company purchased merchandise on account from a British firm for 200,000 British pounds. Assume the exchange rates for the British pound were as follows:  The exchange rate gain/loss for the Canadian company on this transaction was:

The exchange rate gain/loss for the Canadian company on this transaction was:

A) $8,000 loss

B) $2,000 loss

C) $2,000 gain

D) $8,000 gain

Correct Answer:

Verified

Q62: Long-term bond investments are reported on the

Q66: Amortizing a discount on a bond investment

Q67: A foreign-currency transaction gain/loss is reported on

Q68: On March 1, 2015, Uncontracted Capacity Company

Q69: A foreign-currency translation adjustment is reported on

Q70: The amortization of a discount on a

Q76: When referring to foreign-currency transactions, hedging is

Q77: Barking Power Corporation acquired 80% of the

Q80: Amortizing a discount on a long-term bond

Q94: Amortizing a premium on a bond investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents