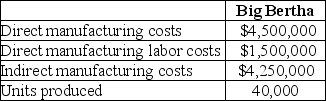

Springfield Manufacturing produces electronic storage devices, and uses the following three-part classification for its manufacturing costs: direct materials, direct manufacturing labor, and indirect manufacturing costs. Total indirect manufacturing costs for January were $300 million, and were allocated to each product on the basis of direct manufacturing labor costs of each line. Summary data (in millions)for January for the most popular electronic storage device, the Big Bertha, was:

Required:

Required:

a. Compute the manufacturing cost per unit for each product produced in January.

b. Suppose production will be reduced to 30,000 units in February. Speculate as to whether the unit costs in February will most likely be higher or lower than unit costs in January; it is not necessary to calculate the exact February unit cost. Briefly explain your reasoning.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q192: For external reporting, GAAP requires that costs

Q193: Whippany manufacturing wants to estimate costs for

Q194: Depreciation can be classified as either an

Q195: Product costs may refer to:

A)inventoriable costs for

Q196: Messinger Manufacturing Company had the following account

Q198: Product cost for financial statement purposes may

Q199: Each of the following items pertains to

Q200: Helmer Sporting Goods Company manufactured 100,000 units

Q201: Product costs used for pricing and product-mix

Q202: A product cost that is useful for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents