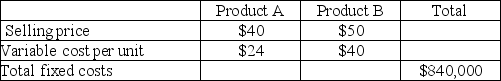

Mount Carmel Company sells only two products, Product A and Product B.  Mount Carmel sells two units of Product A for each unit it sells of Product B. Mount Carmel faces a tax rate of 30%. Mount Carmel desires a net after-tax income of $73,500. The breakeven point in units would be:

Mount Carmel sells two units of Product A for each unit it sells of Product B. Mount Carmel faces a tax rate of 30%. Mount Carmel desires a net after-tax income of $73,500. The breakeven point in units would be:

A) 21,750 units of Product A and 43,500 units of Product B

B) 22,500 units of Product A and 45,000 units of product B

C) 43,500 units of Product A and 21,750 units of Product B

D) 45,000 units of Product A and 22,500 units of Product B

Correct Answer:

Verified

Q174: In multiproduct situations when sales mix shifts

Q183: Ballpark Concessions currently sells hot dogs. During

Q193: Pennsylvania Valve Company makes three types of

Q193: Ken's Beer Emporium sells beer and ale

Q195: Karen Hefner, a florist, operates retail stores

Q196: Events, as distinguished from actions, would include:

A)personnel

Q199: "Uncertainty" may be defined as:

A)the possibility that

Q200: Expected monetary value may be defined as:

A)the

Q202: Lauren had been a manager of a

Q210: Answer the following questions using the information

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents