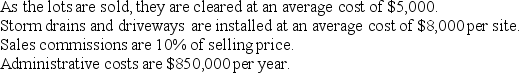

Johnson Realty bought a 2,000-acre island for $10,000,000 and divided it into 200 equal size lots.

The average selling price was $160,000 per lot during 20X5 when 50 lots were sold.

The average selling price was $160,000 per lot during 20X5 when 50 lots were sold.

During 20X6, the company bought another 2,000-acre island and developed it exactly the same way. Lot sales in 20X6 totaled 300 with an average selling price of $160,000. All costs were the same as in 20X5.

Required:

Prepare income statements for both years using both absorption and variable costing methods.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Answer the following questions using the information

Q57: Answer the following questions using the information

Q58: Answer the following questions using the information

Q59: The difference between operating incomes under variable

Q60: Which of the following statements is FALSE?

A)Absorption

Q62: At the end of the accounting period

Q64: When variable costing is used, an income

Q65: When production deviates from the denominator level,

Q66: Direct costing is a perfect way to

Q71: The contribution-margin format of the income statement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents