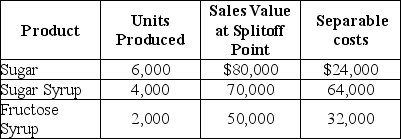

Sugar Cane Company processes sugar cane into three products. During May, the joint costs of processing were $240,000. Production and sales value information for the month were as follows:

Required:

Required:

Determine the amount of joint cost allocated to each product if the sales value at splitoff method is used.

Correct Answer:

Verified

Q88: A criticism of the practice of carrying

Q89: What is the reason that accountants do

Q90: Calamata Corporation processes a single material into

Q92: Oregon Lumber processes timber into four products.

Q94: Zenon Chemical, Inc., processes pine rosin into

Q97: The constant gross-margin percentage NRV method allocates

Q98: Red Sauce Canning Company processes tomatoes into

Q103: Paragon University operates an extensive and an

Q115: For each of the following methods of

Q119: The constant gross-margin percentage NRV method allocates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents