Answer the following questions using the information below:

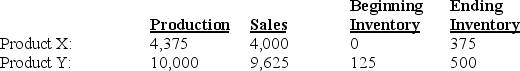

Athens Company processes 15,000 gallons of direct materials to produce two products, Product X and Product Y. Product X sells for $8 per gallon and Product Y, the main product, sells for $100 per gallon. The following information is for August:

The manufacturing costs totaled $30,000.

The manufacturing costs totaled $30,000.

-What is the byproduct's net revenue reduction if byproducts are recognized in the general ledger during production and their revenues are a reduction of cost?

A) $0

B) $3,000

C) $32,000

D) $35,000

Correct Answer:

Verified

Q89: The sales value at split-off method of

Q97: The constant gross-margin percentage NRV method allocates

Q98: Red Sauce Canning Company processes tomatoes into

Q101: Which cost allocation method should NOT be

Q104: The production method for recognizing byproducts is

Q106: Which method of accounting recognizes byproducts in

Q109: Pilgrim Corporation processes frozen turkeys. The company

Q123: What factor most often drives joint cost

Q133: The constant gross-margin percentage NRV method makes

Q148: Byproducts are recognized in the general ledger

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents