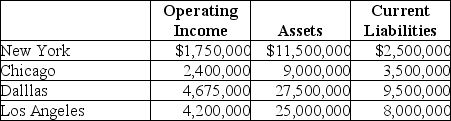

Coptermagic Company supplies helicopters to corporate clients. Coptermagic has two sources of funds: long term debt with a market and book value of $32 million issued at an interest rate of 10%, and equity capital that has a market value of $18 million (book value of $8 million). The cost of equity capital for Coptermagic is 15%, and its tax rate is 30%. Coptermagic has profit centers in four divisions that operate autonomously. The company's results for 2008 are as follows:

Required:

Required:

a. Compute Coptermagic's weighted average cost of capital.

b. Compute each division's Economic Value Added.

c. Rank the divisions by EVA.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Kase Tractor Company allows its divisions to

Q81: Hargrave Products has three divisions, which operate

Q81: Answer the following questions using the

Q82: Bob's Cellular Phone Company uses ROI to

Q84: When using the historical cost of assets

Q87: The cost today of purchasing an asset

Q89: Using net book value as an investment

Q90: The economic value added concept has attracted

Q95: Current cost return on investment is a

Q97: Answer the following questions using the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents