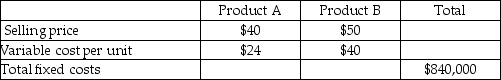

Mount Carmel Company sells only two products, Product A and Product B.  Mount Carmel sells two units of Product A for each unit it sells of Product B. Mount Carmel faces a tax rate of 30%. Mount Carmel desires a net after-tax income of $73,500. The number of units needed to be sold to achieve the desired after-tax profit would be

Mount Carmel sells two units of Product A for each unit it sells of Product B. Mount Carmel faces a tax rate of 30%. Mount Carmel desires a net after-tax income of $73,500. The number of units needed to be sold to achieve the desired after-tax profit would be

A) 21,750 units of Product A and 43,500 units of Product B.

B) 22,500 units of Product A and 22,500 units of product B.

C) 43,500 units of Product A and 21,750 units of Product B.

D) 45,000 units of Product A and 22,500 units of Product B.

E) 64,616 units of Product A and 32,308 units of Product B.

Correct Answer:

Verified

Q134: Assuming a constant mix of 3 units

Q135: Karen's Klothes sells blouses for women and

Q138: The agency supervisor of a non-profit organization

Q141: Use the information below to answer the

Q143: Use the information below to answer the

Q150: Answer the following question(s)using the information below.The

Q153: Use the information below to answer the

Q158: Answer the following question(s)using the information below.The

Q160: Use the information below to answer the

Q162: Ballpark Concessions currently sells hot dogs.During a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents