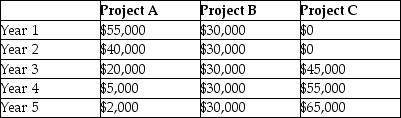

Lion Enterprises Inc. is evaluating 3 investment alternatives. Each alternative requires a cash outflow of $102,000. The cash inflows are summarized below (ignore taxes):

The company has a required rate of return of 9%.

The company has a required rate of return of 9%.

Required:

Evaluate and rank each alternative using net present value (NPV).

Correct Answer:

Verified

NPV = $2,411.57

CF0 - $102,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: If the internal rate of return is

Q31: The discount rate, hurdle rate, or (opportunity)cost

Q32: The primary advantage of the internal rate

Q38: When all future cash inflows and outflows

Q45: The net present value method is extremely

Q46: If the net present value analyses of

Q51: Briefly describe the processes in the Capital

Q65: A capital budgeting project is accepted if

Q76: Internal rate of return is a method

Q148: The accrual accounting rate of return is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents