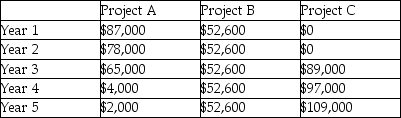

Hiroshima Inc. is evaluating 3 investment alternatives. Each alternative requires a cash outflow of $176,000 and is to be depreciated on a straight line basis ($6,000 salvage value). Ignore income taxes. Cash flows for the various investments are summarized below:

The company has a required rate of return of 11.2%

The company has a required rate of return of 11.2%

Required:

a. Evaluate and rank each alternative based on NPV

c. Evaluate and rank each alternative based on Accrual Accounting Return using average annualcash flows.

c. Evaluate and rank each alternative based on Accrual Accounting Return using average annualcash flows.

d. Evaluate each project based on payback period.

e. Which project do you recommend and why? Address the issue of risk in your response.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q95: Fisher Ltd. is considering the purchase of

Q96: Terrain Vehicle has received three proposals for

Q98: Neptune Ltd. wants to expand its operations

Q101: ABC Boat Company is interested in replacing

Q102: A company is considering purchasing a new

Q103: Mercury Ltd. is considering purchasing laser equipment

Q104: Hentgen and Ferraro, baseball consultants, are in

Q105: Crofton Inc. is evaluating new machinery in

Q125: Depreciation charges

A)are not relevant in capital budgeting

Q132: Relevant cash flows are expected future cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents