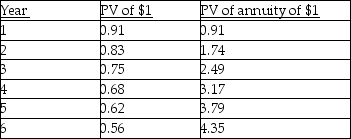

For Years 1 through 6 Better Products Ltd. had annual net income of $20,000, CCA of $40,000 each year, a 40 percent tax rate, a discount rate of 10 percent and annual cash sales of $200,000. The depreciable assets of Better Products belong in several different classes under the Income tax Act, have a salvage value of zero at the end of six years, and were all bought new at the beginning of Year 1. The present value factors, in simplified form, for 10 percent are:

-What is the annual expense deduction for CCA?

A) $16,000

B) $24,000

C) $36,000

D) $40,000

E) $42,500

Correct Answer:

Verified

Q32: A new machine will cost $500,000. It

Q33: When calculating the lost tax shield concerning

Q34: The three factors that generally influence depreciation

Q35: Which of the following statements is true?

A)

Q36: What are the tax savings in year

Q39: Based on the above data only, what

Q40: For Years 1 through 6 Better Products

Q108: Which of the following are not considered

Q109: Clock Manufacturing Company purchased a new piece

Q137: Headwaters Ltd.is considering purchasing a new asset.It

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents