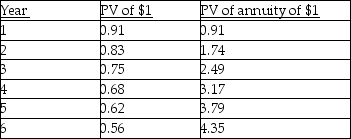

For Years 1 through 6 Better Products Ltd. had annual net income of $20,000, CCA of $40,000 each year, a 40 percent tax rate, a discount rate of 10 percent and annual cash sales of $200,000. The depreciable assets of Better Products belong in several different classes under the Income tax Act, have a salvage value of zero at the end of six years, and were all bought new at the beginning of Year 1. The present value factors, in simplified form, for 10 percent are:

-Biermann Equipment is a publicly held corporation required to pay income taxes. For the current year it had revenues of $5,000,000 and cash expenses of $3,000,000, and claimed CCA of $200,000. The company has a 30 percent tax rate. What would be the net cash flow for the current year if all revenues were received in cash?

A) $600,000

B) $1,260,000

C) $1,460,000

D) $1,800,000

E) $2,000,000

Correct Answer:

Verified

Q19: After-tax savings from an operating cash outflow

Q22: A company purchased a class 8 asset

Q23: What is the balance in the Class

Q24: Canada, like most taxing authorities, uses different

Q26: A company purchased computer equipment that is

Q83: After-tax cash operating flows are equal to

A)(one

Q92: The Income Tax Act classifies every amortizable

Q100: CCA reduces taxable income, and therefore reduces

Q111: Depreciation tax deductions result in tax savings

Q120: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents