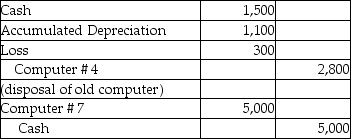

A company purchased computer equipment that is Class 10 for Income Tax purposes (Class 10 is declining balance, but with a 30% rate) . The company made the following two journal entries:  How is the $300 loss treated in discounted cash flow analysis?

How is the $300 loss treated in discounted cash flow analysis?

A) It reduces the net additions to class 10 for calculating CCA.

B) The loss times the tax rate is an after-tax cash flow.

C) The loss plus the accumulated amortization are disposals for class 10.

D) It reduces the net additions to class 10 for calculating CCA, and (the loss) times (the tax rate) is an after-tax cash flow.

E) It is ignored.

Correct Answer:

Verified

Q21: For Years 1 through 6 Better Products

Q22: A company purchased a class 8 asset

Q23: What is the balance in the Class

Q24: Canada, like most taxing authorities, uses different

Q27: For Years 1 through 6 Better Products

Q28: The income tax depreciation method referred to

Q29: What is the CCA claim in year

Q31: Wilf Company acquired an additional Class 10

Q105: A project's net present value is increased

Q120: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents