Exar Construction Ltd is contemplating the purchase of new equipment. The equipment would cost $40,000, have an expected life of 8 years, and a zero terminal salvage value. The equipment would be Class 8 (20% CCA rate), and would generate $125,000 additional revenue annually, and Exar would incur additional annual expenses of $115,000 for labour and material. The company's marginal tax rate is 20%, and the required after-tax rate of return is 14%.

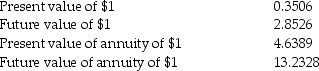

Additional data (for interest rate of 14%, 8 periods):

Required:

Required:

Calculate the net after-tax present value, and determine whether Exar should purchase the equipment.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q58: Based on the above data only, what

Q59: The total project approach calculates the future

Q60: What are the tax savings in year

Q61: What is the net present value of

Q62: What is the net present value of

Q64: What is the net present value of

Q65: The Toronto Deli & Cafeteria adjoins a

Q66: The Columbian Coffee Company is planning on

Q67: The real rate of return is the

Q68: Declines in the general purchasing power of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents