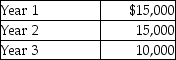

The Columbian Coffee Company is planning on purchasing a special coffee grinding machine that costs $30,000 and is in a CCA class with a 20% rate. The company has decided to use its traditional real rate of return of 10 percent as the required rate of return. It is anticipated the equipment will generate net savings in nominal before-tax dollars as follows:  The anticipated salvage value of the equipment at the end of three years is $5,000 and is not taxable. The income tax rate of Columbian Coffee is 40 percent.

The anticipated salvage value of the equipment at the end of three years is $5,000 and is not taxable. The income tax rate of Columbian Coffee is 40 percent.

What is the after-tax net present value of the investment?

A) $(12,220)

B) $(1,941)

C) $(5,700)

D) $(14,080)

E) $(14,000)

Correct Answer:

Verified

Q61: What is the net present value of

Q62: What is the net present value of

Q63: Exar Construction Ltd is contemplating the purchase

Q64: What is the net present value of

Q65: The Toronto Deli & Cafeteria adjoins a

Q67: The real rate of return is the

Q68: Declines in the general purchasing power of

Q69: Jasper Company Ltd. has a payback goal

Q70: It is an error when accounting for

Q71: Good Bread Bakery installed an oven costing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents