Use the information below to answer the following question(s) .

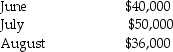

Barry operates a shop in a resort in an area known for its high inflation rate. The inflation rate for the last few years has been averaging 3 percent a month. His long-term real rate of return is 12 percent, or 1 percent a month. On April 1 he anticipates that real dollar sales during the summer will be as follows:

-Assume that in recent years a global economic crisis has produced a very high annual inflation rate of 25 percent. Kenyan Coffee has decided to use a nominal rate to determine capital budgeting decisions. Its traditional real rate of return is 10 percent. What is the company's nominal traditional rate of return?

A) 0.100

B) 0.250

C) 0.300

D) 0.350

E) 0.375

Correct Answer:

Verified

Q80: Avilas Corp. has a marginal tax rate

Q82: The required rate of return is the

Q83: Use the information below to answer the

Q84: When cash flows are stated in real

Q86: The nominal rate of return would be

Q87: Carter Ltd. is considering purchasing a new

Q88: The strategic planning manager of Sports Discount

Q89: A company's General Ledger recorded sales of

Q90: Some companies adjust the estimated future cash

Q144: How is inflation related to capital budgeting?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents