Carter Ltd. is considering purchasing a new machine which will increase its current capacity of 100,000 units by 20%. The new machine, which will be acquired on January 1 of year 1 costs $4,000,000. Carter will also incur installation costs of $400,000 which are eligible for capital cost allowance. The new machine will have a useful life of 5 years and an estimated residual value of $200,000. The current machine has an undepreciated capital cost equal to its salvage value as at January 1, year 1 of $200,000. Annual depreciation of $45,000 calculated on a straight line basis is being recorded. The applicable capital cost allowance rate for both machines is 30%.

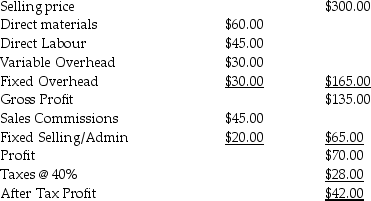

Budgeted unit cost data for Year 1 assuming an activity level of 90,000 units are as follows:

Additional information is as follows:

Additional information is as follows:

• Sales commissions are 15% of sales.

• Variable and fixed manufacturing overheads are applied on the basis of machine hours.

• The new machine is expected to reduce direct materials costs by 5% and direct labour costs by 20%

• It is estimated unit sales will increase by 3,000 units/year for years 1 to 5 inclusive.

• Inflation on selling prices and variable costs is predicted at 8%/year.

• If the old machine is not replaced it will require maintenance expenses of $50,000 in year 2 and another $30,000 in the year 4.

• If the old machine is not replaced it will require maintenance expenses of $50,000 in year 2 and another $30,000 in the year 4.

• The company requires a real return of 11%

• The asset will be sold before year end of year 5 and therefore will not be eligible for CCA in year 5.

Required:

Should the new machine be purchased?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: The required rate of return is the

Q83: Use the information below to answer the

Q84: When cash flows are stated in real

Q85: Use the information below to answer the

Q86: The nominal rate of return would be

Q88: The strategic planning manager of Sports Discount

Q89: A company's General Ledger recorded sales of

Q90: Some companies adjust the estimated future cash

Q91: Companies may vary the required payback in

Q92: The most frequently encountered error when accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents