Broughton Ltd. manufactures and sells one product with a projected contribution margin of $17.00 for year 1. The total budgeted fixed costs are $925,000. Selling prices and variable costs are projected to increase by 8% per year, while fixed costs are forecast to grow at a rate of 5% per year. Existing production capacity is 105,000 units.

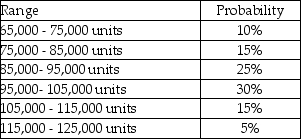

The probability distribution on its forecasted demand is as follows:

The company is considering purchasing a new machine which will increase its production capacity by 30,000 units. The machine costs $175,000 with a residual value of $40,000 after its useful life of 5 years. The applicable Capital Cost Allowance rate is 20%. The company's tax rate is 40% and it requires an after-tax rate of return on capital of 10% (including provision for inflation).

The company is considering purchasing a new machine which will increase its production capacity by 30,000 units. The machine costs $175,000 with a residual value of $40,000 after its useful life of 5 years. The applicable Capital Cost Allowance rate is 20%. The company's tax rate is 40% and it requires an after-tax rate of return on capital of 10% (including provision for inflation).

Required:

Should Broughton purchase the new machine based on NPV analysis? Assume the machine will be sold on January 1 of year 6 for tax purposes.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: The excess present value index is the

Q104: The profitability index

A) measures the profit per

Q105: Discounted cash flow analysis can be applied

Q106: Using the certainty equivalent approach means that

A)

Q107: Which of the following methods is not

Q109: Explain how the profitability index can be

Q110: The required rate of return is a

Q111: The division manager of Bagley Company asked

Q112: The excess present value index is

A) the

Q113: Discuss the ways a company can account

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents