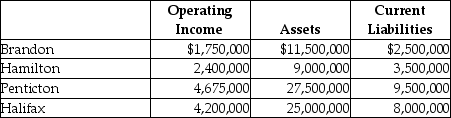

Coptermagic Company supplies helicopters to corporate clients. Coptermagic has two sources of funds: long term debt with a market and book value of $32 million issued at an interest rate of 10%, and equity capital that has a market value of $18 million (book value of $8 million). The cost of equity capital for Coptermagic is 15%, and its tax rate is 30%. Coptermagic has profit centres in four divisions that operate autonomously. The company's results for the past year are as follows:

Required:

Required:

a. Compute Coptermagic's weighted average cost of capital.

b. Compute each division's Economic Value Added.

c. Rank the divisions by EVA.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: The Coffee Division of Canadian Products is

Q65: Kase Tractor Company allows its divisions to

Q66: Kase Tractor Company allows its divisions to

Q69: The executive vice president of Wicker Pen

Q70: Museum Corporation uses the investment centre concept

Q71: Batman Abstract Company has three divisions that

Q72: Randall Ltd. reported the following results for

Q73: Outline and discuss the steps involved in

Q85: Chaucer Ltd.has current assets of $450,000 and

Q99: R & D Storage is a small,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents