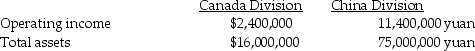

The Irnakk Corporation manufactures iPod covers in Canada and China. The operations are organized as decentralized divisions. The following information is available for the year just ended:

The exchange rate at the time of Irnakk's investment (the end of the previous year) in China was 7.5 Chinese yuan = $1 Canadian. During the year, the yuan declined steadily in value and the exchange rate at the end of the current year was 8.5 yuan = $1 Canadian. The average exchange rate during the year was 8 yuan = $1 Canadian.

The exchange rate at the time of Irnakk's investment (the end of the previous year) in China was 7.5 Chinese yuan = $1 Canadian. During the year, the yuan declined steadily in value and the exchange rate at the end of the current year was 8.5 yuan = $1 Canadian. The average exchange rate during the year was 8 yuan = $1 Canadian.

Required:

a. Calculate the Canadian Division's ROI for last year based on dollars.

b. Calculate the Chinese Division's ROI for last year based on yuan.

c. Which of Irnakk's two divisions earned the better ROI? Explain your answer, complete with supporting calculations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q116: Team incentives encourage cooperation by

A) forcing people

Q119: A multinational established a division in a

Q120: Which of the following statements is true

Q121: Benchmarks represent 'best practices', and can be

Q126: Divisions operating in different countries often record

Q129: An important consideration in designing compensation arrangements

Q140: Well-designed compensation plans for executives focus on

Q144: Ethical behaviour on the part of managers,

Q147: Bob Cellular Phone uses ROI to measure

Q159: The absence of good performance measures restricts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents