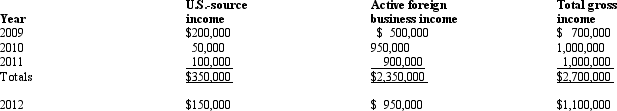

During 2012, Martina, an NRA, receives interest income of $50,000 from Collins, Inc., an unrelated U.S. corporation. Considering the following facts related to Collins' operations, what is the source of the interest income received by Martina?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q123: With respect to income generated by non-U.S.

Q125: The § 367 cross-border transfer rules seem

Q126: Discuss the primary purposes of income tax

Q146: Freiburg, Ltd., a foreign corporation, operates a

Q149: USCo has foreign-source income from a manufacturing

Q151: Goolsbee, Inc., a domestic corporation, generates U.S.-source

Q152: Given the following information, determine whether Greta,

Q153: BrazilCo, Inc., a foreign corporation with a

Q158: Arendt, Inc., a domestic corporation, purchases a

Q159: Present, Inc., a domestic corporation, owns 60%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents