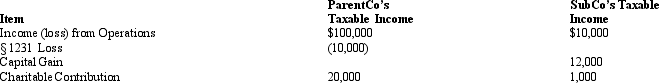

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $91,000.

B) $100,800.

C) $112,000.

D) $122,000.

Correct Answer:

Verified

Q65: ParentCo's separate taxable income was $200,000, and

Q78: ParentCo purchased all of the stock of

Q78: ParentCo's separate taxable income was $200,000, and

Q79: The Philstrom consolidated group reported the following

Q80: ParentCo, SubOne and SubTwo have filed consolidated

Q82: When an affiliated group elects to file

Q84: Members of an affiliated group must share

Q96: Consolidated return members determine which affiliates will

Q97: Most of the rules governing the use

Q100: If,on joining an affiliated group,SubCo has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents