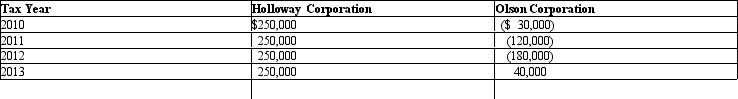

Compute consolidated taxable income for the calendar year Holloway Group, which elected consolidated status immediately upon creation of the two member corporations in January 2010. All recognized income related to the data processing services of the firms. No intercompany transactions were completed during the indicated years.

Correct Answer:

Verified

2010 $220,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: Within a Federal consolidated income tax group,

Q107: If there is a balance in the

Q108: The casualty/theft gain/loss of the affiliates is

Q109: ParentCo's controlled group includes the following members.

Q110: Dividends paid by a subsidiary to the

Q112: In computing consolidated taxable income, a charitable

Q113: LargeCo files on a consolidated basis with

Q114: The capital gain/loss of the affiliates is

Q115: If the negative adjustments to the stock

Q116: The consolidated return rules combine the members'

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents