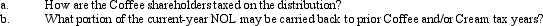

On March 1, Cream Corporation transfers all of its assets to Coffee Corporation in exchange for 10% of its common voting stock. At the time of the reorganization, Cream has assets valued at $4 million (basis of $3 million) and its earnings and profits account shows a deficit of $650,000. Coffee's earnings and profits as of March 1 were $420,000. Due to the reorganization, Coffee has an NOL for the current year of $150,000. Coffee still declares its usual dividends of $100,000, paid on April 30, August 31, and December 31 ($300,000 of total dividends).

Correct Answer:

Verified

Q97: Lyon has 100,000 shares outstanding that are

Q106: Present Value Tables needed for this question.

Q107: Explain how the tax treatment for parties

Q109: NewCo received all of DebtCo's assets (value

Q110: Iron Corporation was created 10 years ago.

Q111: Compare an acquisitive "Type D" reorganization with

Q112: Pipe Corporation is very interested in acquiring

Q113: Once a gain is recognized in a

Q114: Present Value Tables needed for this question.

Q129: Compare the consideration that can be used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents