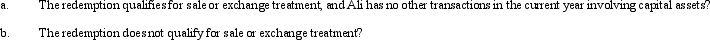

Ali is in the 35% tax bracket. He acquired 1,000 shares of stock in Cardinal Corporation seven years ago for $100 a share. In the current year, Cardinal Corporation (E & P of $1 million) redeems all of his shares for $300,000. What are the tax consequences to Ali if:

Correct Answer:

Verified

Q82: After a plan of complete liquidation has

Q83: Penguin Corporation purchased bonds (basis of $95,000)

Q84: Ivory Corporation (E & P of $650,000)

Q86: Sam's gross estate includes stock in Tern

Q88: The stock of Brown Corporation (E &

Q89: During the current year, Ecru Corporation is

Q90: Jill has a capital loss carryover in

Q91: Fred is the sole shareholder of Puce

Q92: During the current year, Goldfinch Corporation purchased

Q100: Egret Corporation has manufactured recreational vehicles for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents