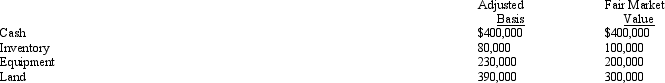

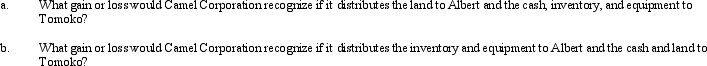

The stock in Camel Corporation is owned by Albert and Tomoko, who are unrelated. Albert owns 30% and Tomoko owns 70% of the stock in Camel Corporation. All of Camel Corporation's assets were acquired by purchase. The following assets are to be distributed in complete liquidation of Camel Corporation:

Correct Answer:

Verified

Q94: Indigo has a basis of $1 million

Q95: In the current year, Dove Corporation (E

Q96: The gross estate of Raul, decedent who

Q97: Which of the following statements is correct

Q98: Three years ago, Loon Corporation purchased 100%

Q100: On April 7, 2010, Crow Corporation acquired

Q101: On April 16, 2010, Blue Corporation purchased

Q102: The partial liquidation rules provide a unique

Q103: Discuss the tax consequences associated with a

Q183: When is a redemption to pay death

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents