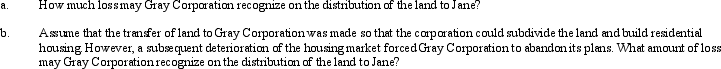

Mary and Jane, unrelated taxpayers, own Gray Corporation's stock equally. One year before the complete liquidation of Gray, Mary transfers land (basis of $420,000, fair market value of $350,000) to Gray Corporation as a contribution to capital. Assume that Mary also contributed other property in the same transaction having a basis of $20,000 and fair market value of $95,000. In liquidation, Gray distributes the land to Jane. At the time of the liquidation, the land is worth $290,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q47: The stock of Tan Corporation (E &

Q62: The text discusses four different limitations on

Q102: The partial liquidation rules provide a unique

Q103: Discuss the tax consequences associated with a

Q106: Describe the requirements for and tax consequences

Q107: What are the tax consequences of a

Q144: Explain the requirements for waiving the family

Q145: What are the tax consequences of a

Q161: Explain the stock attribution rules that apply

Q183: When is a redemption to pay death

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents