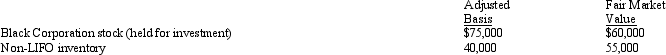

In the current year, Verdigris Corporation (with E & P of $250,000) made the following property distributions to its shareholders (all corporations) :  Verdigris Corporation is not a member of a controlled group. As a result of the distribution:

Verdigris Corporation is not a member of a controlled group. As a result of the distribution:

A) The shareholders have dividend income of $100,000.

B) The shareholders have dividend income of $130,000.

C) Verdigris has a gain of $15,000 and a loss of $15,000, both of which it must recognize.

D) Verdigris has no recognized gain or loss.

E) None of the above.

Correct Answer:

Verified

Q67: On January 1, Gull Corporation (a calendar

Q71: Ten years ago, Connie purchased 4,000 shares

Q73: Blue Corporation distributes property to its sole

Q74: Which of the following is not an

Q77: Navy Corporation makes a property distribution to

Q80: Purple Corporation has accumulated E & P

Q82: At the beginning of the current year,Doug

Q84: Which one of the following statements about

Q86: Swan Corporation makes a property distribution to

Q100: Pink Corporation declares a nontaxable dividend payable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents