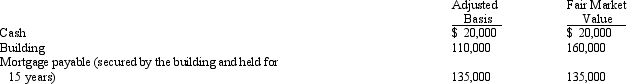

Tim, a cash basis taxpayer, incorporates his sole proprietorship. He transfers the following items to newly created Wren Corporation.  With respect to this transaction:

With respect to this transaction:

A) Wren Corporation's basis in the building is $110,000.

B) Tim has no recognized gain.

C) Tim has a recognized gain of $25,000.

D) Tim has a recognized gain of $5,000.

E) None of the above.

Correct Answer:

Verified

Q43: Hunter and Warren form Tan Corporation. Hunter

Q44: Rick transferred the following assets and liabilities

Q45: A corporation's holding period for property received

Q46: Ann, Irene, and Bob incorporate their respective

Q47: Kim owns 100% of the stock of

Q49: Ann transferred land worth $200,000, with a

Q49: Sarah and Emily form Red Corporation with

Q56: Amy owns 20% of the stock of

Q67: Wade and Paul form Swan Corporation with

Q95: Mary transfers a building (adjusted basis of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents