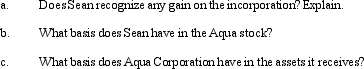

Sean, a sole proprietor, is engaged in a service business and uses the cash basis of accounting. In the current year, Sean incorporates his business by forming Aqua Corporation. In exchange for all of its stock, Aqua receives: assets (basis of $400,000 and fair market value of $2 million), trade accounts payable of $110,000, and loan due to a bank of $390,000. The proceeds from the bank loan were used by Sean to provide operating funds for the business. Aqua Corporation assumes all of the liabilities transferred to it.

Correct Answer:

Verified

Q84: In order to encourage the development of

Q85: In 2004, Donna transferred assets (basis of

Q86: Barry and Irv form Swift Corporation. Barry

Q89: Issues relating to basis arise when a

Q92: What are the tax consequences if an

Q92: Linda formed Pink Corporation with an investment

Q93: Five years ago, Joe, a single taxpayer,

Q101: Stock in Merlin Corporation is held equally

Q101: How is the transfer of liabilities in

Q106: What is the rationale underlying the tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents