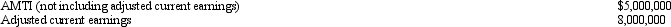

During 2011, Gold Corporation (a calendar year taxpayer) has $4,000,000 of taxable income and the following transactions:  Gold Corporation's alternative minimum tax (AMT) for 2011 is:

Gold Corporation's alternative minimum tax (AMT) for 2011 is:

A) $1,360,000.

B) $700,000.

C) $500,000.

D) $90,000.

E) None of the above.

Correct Answer:

Verified

Q82: A small corporation with unused minimum tax

Q84: Maroon Corporation incurred the following taxes for

Q84: Cave Corporation,a calendar year taxpayer,has a beginning

Q86: Chase Corporation manufactures and sells birdhouses and

Q89: In each of the following independent situations,

Q90: Ford Corporation, a calendar year corporation, has

Q91: Maize Corporation has gross receipts of $3

Q91: In 2011, Fay Corporation (a calendar year

Q92: Which entity is subject to the ACE

Q92: For purposes of the penalty tax on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents