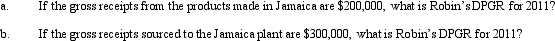

Robin Corporation, a calendar year taxpayer, manufactures and sells candles. It has several factories in the U.S. and one in Jamaica. During 2011, it had DPGR of $4.1 million from the U.S. factories.

Correct Answer:

Verified

Q81: Which of the following is always personal

Q92: The exemption amount is phased out entirely

Q95: Tanver Corporation, a calendar year corporation, has

Q96: Ecru Corporation sells customized outdoor grills. The

Q97: What amount of accumulated earnings of a

Q99: Ravi Corporation, a calendar year taxpayer, has

Q100: Emerald, Inc. engages in production activities that

Q101: What is personal holding company income?

Q102: a. Calculate the personal holding company tax

Q104: Why is the DPAD benefit somewhat unique?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents