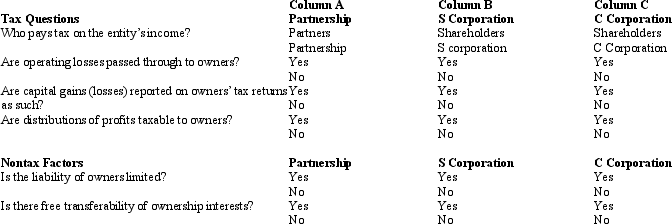

Compare the basic tax and nontax factors of doing business as a partnership, an S corporation, and a C corporation. Circle the correct answers.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: Jade Corporation, a C corporation, had $100,000

Q79: Grocer Services Corporation (a calendar year taxpayer),

Q81: Which of the following statements is incorrect

Q82: During the current year, Lavender Corporation, a

Q83: Warbler Corporation, an accrual method regular corporation,

Q85: Almond Corporation, a calendar year C corporation,

Q86: Osprey Company had a net loss of

Q87: Vireo Corporation, a calendar year C corporation,

Q88: Canary Corporation, an accrual method C corporation,

Q89: During the current year, Quartz Corporation (a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents