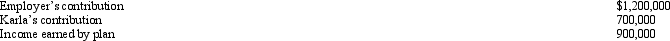

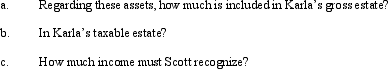

At the time of her death in 2011, Karla was a participant in her employer's qualified pension plan. Her accrued balance in the plan is:

Karla also was covered by her employer's group term life insurance program. Her policy (maturity value of $200,000) is made payable to Scott (Karla's husband). Scott is also the designated beneficiary of the pension plan.

Karla also was covered by her employer's group term life insurance program. Her policy (maturity value of $200,000) is made payable to Scott (Karla's husband). Scott is also the designated beneficiary of the pension plan.

Correct Answer:

Verified

Q118: Pursuant to Corey's will,Emma (Corey's sister) inherits

Q131: At the time of his death, Lance

Q132: At the time of her death, Megan

Q133: Gerald and Pat are husband and wife

Q134: Homer and Laura are husband and wife.

Q135: In 1980, Mandy and Hal (mother and

Q137: Ben and Lynn are married and have

Q138: At the time of his death on

Q140: In 2009, Glen transferred several assets by

Q141: As reflected by the tax law, Congressional

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents