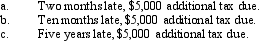

Isaiah filed his Federal income tax return on time, but he did not remit the full balance due. Compute Isaiah's failure to pay penalty in each of the following cases. The IRS has not yet issued a deficiency notice.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: Leo underpaid his taxes by $250,000.Portions of

Q128: Clara underpaid her taxes by $50,000.Of this

Q133: Compute the overvaluation penalty for each of

Q137: Bettie, a calendar year individual taxpayer, files

Q140: Troy Center Ltd.withheld from its employees' paychecks

Q140: Compute the failure to pay and failure

Q143: The client has decided to dispute the

Q156: A tax professional needs to know how

Q164: In connection with the taxpayer penalty for

Q173: Circular 230 requires that the tax practitioner

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents