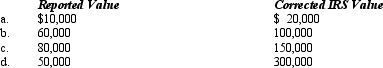

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate. In each case, assume a marginal estate tax rate of 45%.

Correct Answer:

Verified

Q126: Leo underpaid his taxes by $250,000.Portions of

Q128: Clara underpaid her taxes by $50,000.Of this

Q129: Loren Ltd., a calendar year taxpayer, had

Q130: Yin-Li is the preparer of the Form

Q131: The IRS periodically updates its list of

Q133: Compute the overvaluation penalty for each of

Q137: Bettie, a calendar year individual taxpayer, files

Q139: A(n) _ member is required to follow

Q140: Troy Center Ltd.withheld from its employees' paychecks

Q153: The Treasury issues "private letter rulings" and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents