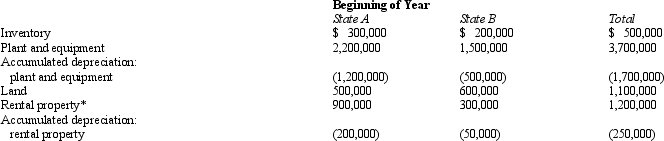

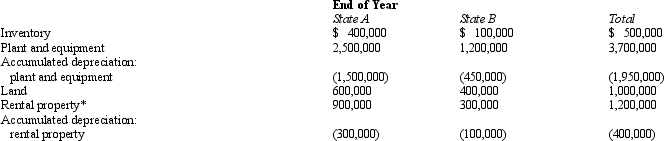

Kim Corporation, a calendar year taxpayer, has manufacturing facilities in States A and

B. A summary of Kim's property holdings follows.

*Unrelated to Kim's regular business and operations.

*Unrelated to Kim's regular business and operations.

Determine Kim's property factors for the two states. A's statutes provide that the average historical cost of business property is to be included in the property factor. B's statutes provide that the property factor is based on the average depreciated basis of in-state business property.

Kim Corporation's property factor is 61.90% for State A, and its property factor for State B is 44.53%. Under the statutes of A and B, nonbusiness property (i.e., the rental property) is not taken into consideration in computing the property factor. The basis for determining the average property in A is historical cost, whereas the value employed for B is depreciated cost.

HISTORICAL COST-EXCLUDING NONBUSINESS PROPERTY

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q109: Overall tax liabilities typically (increase/decrease) if the

Q115: In unitary states, a(n) _ provision permits

Q123: A _ tax is designed to complement

Q126: Milt Corporation owns and operates two facilities

Q128: Determine Bowl's sales factors for States K,

Q129: Provide the required information for Wren Corporation,

Q131: A state sales/use tax is designed to

Q136: The tax levied by a state usually

Q140: The tax usually is applied at the

Q160: An ad valorem property tax is based

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents